Withdrawal of PF and EPS amount for more than 10 years of service For those who have completed 10 years of service, they cannot withdraw the EPS amount; but can get the ‘scheme certificate’ by submitting Form 10C along with the Composite Claim Form – Aadhaar or Non-Aadhaar.

On 20th February, replacing the existing forms of Provident fund withdrawal, Employees Provident Fund Organization (EPFO) has introduced a new EPF Composite Claim Form. The motive behind the introduction of this new form is to simplify the full & partial withdrawal of the Provident fund amount. Now check more details for “New PF withdrawal Form, Single form to withdraw EPF – New Features” from below….

What were the withdrawal forms effective earlier?

| Form | Purpose |

| Form-10c | To claim the Employee Pension Scheme |

| Form 31 | To partially withdraw from your PF account for the purpose like marriage, house buying or medical emergency. |

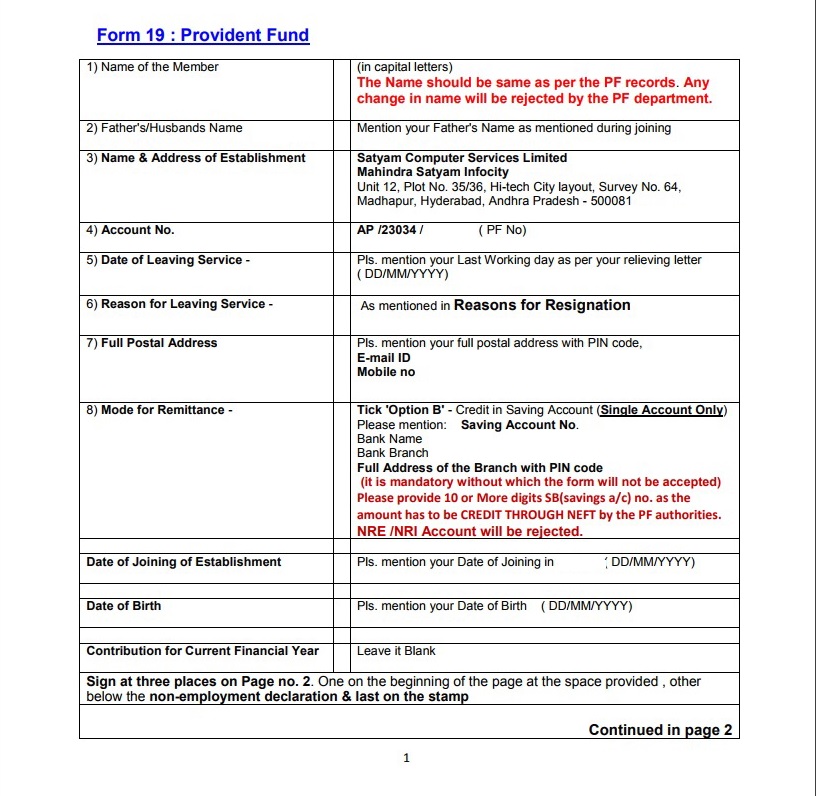

| Form 19 | To withdraw from your PF account at the time of retirement or leaving the job |

Features of new EPF withdrawal form:

1. Replacement of old forms to avoid the hassle of multiple forms:

It has been introduced replacing the existing forms listed in the above table. Hence the existing forms would no longer be used to make a claim.

2. Purposes served: This new form could be used for full and partial withdrawal of your PF.

- EPS (pension) withdrawal

- EPF final settlement

- Partial / advance withdrawal on account of

- Medical treatment of self/family member

- Housing Loan, Purchase of site, Construction of house, renovation of house etc

- One year before retirement

- Marriage of self / son / daughter / brother / sister etc.,

- Investment in Varistha Pension Bima Yojana

Pf Claim Form Download

3. Two forms:

Based on the integration of your Aadhar with the UAN, Two forms were introduced such as

Pf Claim Form 10c

Composite claim form – Aadhar:

If your Uniform account number (UAN) has been linked with Aadhar and bank details, this form can be submitted for all types of withdrawals. The attestation of employer is not required and this form can be submitted to EPFO directly.

Composite claim form – Non Aadhar:

Pf Claim Form 10c Old 18

If your UAN was not linked with Aadhar and bank details, this form can be submitted for all types of PF withdrawals, but the attestation of employer is required and the form must be routed through an employer.

New Instructions for PF withdrawal Form:

- Earlier advance stamped receipt with a 1-rupee revenue stamp was necessary. The same is not required from February 20th

- Purpose of advance & documents required: (The purpose may be one of the following):

- Housing Loan/Purchase of site/house/flat or for construction/Addition alteration in existing house/Repayment of Housing loan: – No document is required. New Declaration Form/Utilization Certificate required earlier has been discontinued.

- Illness of member/family: – i) Certificate of doctor and ii) Certificate by employer that ESIC facility is not available to the member may be submitted by the member.

- Marriage of self/son/daughter/brother/sister: – No document/Marriage Card is required.

- Post Matriculation education of children: No document is required.

- Lockout or closure of factory/Cut in supply of electricity: No document is required

- Natural calamity: No document is required.

- Purchasing equipment by physically handicapped: Medical certificate is required.

- One year before retirement: – 90% of total PF balance can be withdrawn. No document is required.

- Investment in Varistha Pension Bima Yojana: – 90% of total PF balance can be transferred to LIC. No document is required.

Income Tax (TDS) is deducted if the service is less than 5 years (60 months). No Income Tax (TDS) is deducted in case the total balance is less than Rs. 50,000/-. However, TDS is deducted @10% if the applicant submits PAN in such cases. If PAN is not submitted, TDS @34.608% is deducted

Recommended Articles

If you have any query or suggestion regarding “New PF withdrawal Form, Single form to withdraw EPF” then please tell us via below comment box…